Current federal aid allocation policies do an admirable job of targeting aid to school districts serving the neediest students. This is not only because they distribute funds through states to local public school districts based largely on proxies for needs and costs such as Census poverty rates (which are fairly effective predictors of K–12 costs) but also because higher-poverty districts are more likely than their affluent counterparts to be underfunded. But these policies have one significant, underlying weakness: they fail to consider states’ effort levels (and their capacities to raise revenue).

This “effort neutral” approach fails to target crucial aid at states with smaller economies and higher costs. These states, despite strong effort levels, cannot possibly meet students’ needs. Conversely, it effectively rewards states that fail to provide adequate funding for all students despite having the capacity to do so.

Our proposal, put simply, is for federal aid to be allocated based not only on student need (as is currently the case), but also on how much states and districts are able and willing to contribute—in other words, based on their effort. With full funding and compliance, this proposal would provide every school district with the estimated revenues necessary to reach the goal of average national outcomes in mathematics and reading.

Some form of this “foundation funding” system is how state and local K–12 funds are distributed in almost all states, at least in theory. States determine how much each district requires to meet the needs of its students—i.e., a “foundation” funding amount. Districts are then expected to contribute a reasonable amount of local revenue toward these costs, given their capacity to raise those funds (e.g., at the same tax rate, a wealthy suburban district will raise far more revenue than a low-income city district). Finally, state aid makes up the difference between this local fair share contribution and the minimum foundation funding level. Our proposal integrates the federal government as the top layer in a national foundation formula, in which the federal government fills the gaps that state and local governments cannot reasonably fill themselves.

In order to understand the conceptual basis for this proposal, it is useful to begin with a brief discussion of, first, how school finance systems should work and, second, how they actually do work.

Current School Finance Systems

On average, about 90 percent of school funding comes from a combination of local and state revenues. Local revenues, mostly from property taxes, are collected and distributed at the school district level, with states exerting substantial control over local revenue by defining the bounded geographic spaces of local districts, determining how properties are valued and taxed, and deciding how those taxes are incorporated into the broader school finance system. State revenues, usually derived mostly from sales and income taxes, are “pooled” and distributed to districts via a statewide funding formula. The details of these formulas vary substantially from state to state, but they are designed, in theory, to accomplish two goals:

- Account for differences in the costs of achieving equal educational opportunity across schools, districts, and the children they serve. Costs vary because student populations vary (e.g., some districts serve larger shares of disadvantaged students than others) and characteristics of school districts vary (e.g., some districts are located in labor markets with higher costs of living than others). School funding formulas attempt to account for these differences by driving additional funding to districts with higher costs.

- Account for differences in fiscal capacity, or the ability of local public school districts to pay for the costs of educating their students. In many states, school districts rely heavily on local property taxes to raise revenues. This advantages wealthier communities: because their property values are higher, they can tax themselves at lower rates. State funding formulas attempt to account for this difference by driving more funding to districts with less capacity to raise local revenues and meet their students’ needs.

These two factors—local costs and local capacity—are strongly (but not perfectly) associated with each other. This creates a compounded issue of sorts, in which districts with the highest costs also tend to be those with the least capacity to raise revenue to pay those costs.

A well-designed state school finance system, therefore, begins by setting a need-/cost-adjusted target level of funding for each local public school district to achieve the desired outcome. Then, the goal is to determine the “local fair share” or “required local effort” to be paid by local communities toward the cost target. This contribution is usually determined with respect to the taxable property wealth of the communities and the income of taxpaying residents. For districts that do not meet their per-pupil cost targets with local revenue alone, state aid is allocated to make up the difference (most districts fall in this category, albeit by degrees that vary widely).

In states that fail to account for these discrepancies with state aid, there are often massive gaps between resources and needs in high-poverty districts. Such failures carry serious consequences for US schoolchildren because money does, indeed, matter.* This conclusion is supported by a growing body of high-quality empirical research regarding the importance of equitable and adequate financing for providing high-quality schooling to all children.1

Sadly, most state school finance systems fall far short of even a realistic approximation of the ideal system and funding gaps (discrepancies between resources and costs/needs) persist. Such gaps are most egregious between local public school districts within the same state—but they are also found between states and even between schools within the same district.2

There are two primary reasons for this failure. The first and often the most basic problem is that most states do not set their district funding targets based on any empirically defensible system. Some states’ targets are products of poorly designed costing studies or no cost analyses at all. Other states rely on consultants who use “evidence-based” methods in which the “evidence” is better described as personal opinion and who are subject to political pressures to understate additional costs associated with student needs. In any case, the failure to set proper target funding levels can serve to justify inequitable funding and relieve pressure to increase revenue or reform how it is distributed.

The second primary reason that state finance systems work less well in practice than in theory is the failure of some states to raise enough revenue to support their schools. Sometimes this failure is due to limited capacity; in other cases, it is essentially a policy choice (e.g., choosing to keep tax rates very low or to cut taxes despite inadequate funding).

We have found that there is no relationship between states’ capacity to fund their schools and their effort. New York and New Jersey, for instance, are high-capacity states that also put forth above-average effort, generating copious K–12 resources statewide. But there are also a number of states, such as Delaware, Massachusetts, and California, that are high capacity and put forth relatively low effort. In contrast, several states, such as Arkansas, Kentucky, Maine, Mississippi, South Carolina, and West Virginia, exhibit rather strong (or at least above average) effort, but their relatively limited capacity (i.e., smaller economies) means that students in those states will be under-resourced vis-à-vis states that put forth similar effort but have greater capacity.

To the extent that states leave it to local communities to raise what they will for local public schools, differences in income and policy choices across local districts will lead to differences in spending, quality, and outcomes. And to the extent the federal government provides a limited share (roughly 10 percent) of all K–12 aid and continues to distribute that limited share without regard to states’ effort and capacity, these differences will continue to drive interstate inequality.

A New Framework for Federal Funding

We propose a new federal aid framework that functions similarly to how state finance systems are supposed to work—that is, by distributing federal aid based on both costs/needs as well as states’ and districts’ ability and willingness to pay their fair shares of bringing all districts up to a minimum adequate level. As a proof of concept, in our report we provide extensive calculations and analysis to simulate one reasonable manifestation of that framework: a voluntary supplemental federal aid program in which eligibility is contingent upon fair share state and local contributions (i.e., minimum effort), and new federal funds fill the gaps between that contribution and adequate funding levels in eligible states. While we encourage readers to read the full report, here we offer a summary of this simulation showing that what’s needed to ensure adequate funding for all districts is reasonable and doable.†

We began our simulation by estimating adequate per-pupil funding levels for the vast majority of public school districts in the United States. These estimates come from the National Education Cost Model, which uses a national database of school district finance data, data on student and district characteristics, and nationally normed testing data. The model determines how student population characteristics (percentage in poverty, percentage of English language learners, percentage of students with disabilities, etc.) and district characteristics (relative wage costs, enrollment size, grade-level enrollments, etc.) affect student outcomes and how much funding is needed to reach a specified outcome goal given these variations. The goal we have chosen is relatively modest: national average outcomes in reading and math.

Today, over half of all US districts are funded below our estimated adequate levels. In many states, most students attend districts with below-adequate funding. But even in those (relatively few) states where most districts’ resources are above our adequacy targets, there are still many that fall through the cracks, and these school districts tend to have the highest costs and least capacity to pay those costs via local revenue. Our simulation calculates the cost of bringing all of these inadequately funded districts up to their target levels. However, eligibility for these additional gap-closing federal funds is contingent upon states and districts contributing a reasonable fair share (if they don’t already do so). We define this fair share contribution in terms of fiscal effort, which is simply total state and local revenue divided by capacity.‡ And we set this minimum effort level at roughly the US average. This fair share requirement ensures that neither the federal government nor states with smaller economies (and/or very high costs) are required to bear a disproportionately large burden in meeting the needs of their student populations, particularly when localities aren’t contributing enough themselves.

The final step in our simulation was allocating new local, state, and federal aid. This procedure entails several sub-steps, models, and tests (which we discuss in the report), but put simply, a combination of new state aid and new local revenue brings states up to the minimum required “fair share” effort levels (if they are not at those levels already) and then distributes the new funding to districts proportionally to their funding gaps. Any district in which this new revenue is insufficient to raise total funding up to adequate levels receives new federal aid to make up the difference. Therefore, one key feature of our proposal is that we achieve universal adequacy without any reduction in revenue in any district or any shifting of current funding between districts.

Adequate Funding Is a Reachable Goal

In our proof-of-concept simulation, we assumed full participation by states (even though our proposed supplemental federal aid program is voluntary). Therefore, our national results represent maximum possible estimates of costs—as well as benefits—in the districts we were able to include (which serve approximately 95 percent of all public school students). We found that:

- Universal adequacy would require roughly $52 billion in additional federal funding annually. Existing (pre-pandemic) federal aid, which constitutes around 10 percent of all K–12 revenue, would roughly double in our full compliance simulation. Yet this increase in federal funds would be accompanied by an additional “fair share” state and local investment of approximately $80 billion, which is an aggregate increase of about 13 percent in total state and local revenue for fiscal year 2019.§ These increases vary widely by state, depending on current effort levels.

- The additional federal funds would be targeted at districts in 34 states. These states (and districts) are those that cannot achieve adequate funding despite meeting minimum state and local effort levels. Based on their current funding levels indicating that they are already paying their fair share, 18 states are “pre-eligible”—i.e., they would not have to increase state and local revenue to be eligible for new federal funds. Conversely, our simulation suggests that roughly a dozen states are not pre-eligible for federal aid and do not need it—they have sufficient capacity to achieve universal adequacy by raising effort up to our fair share minimum levels. Several of these states, such as California, Colorado, Florida, and North Carolina, currently exhibit severe and widespread funding gaps despite having the means to rectify them.

- Full participation in this program would cause a decrease in the percentage of students in inadequately funded districts from about 55 percent to 0 percent. In other words, if all states increased state and local investment up to our target fair share levels, and roughly $52 billion in new federal aid filled the remaining adequacy gaps, around 26 million schoolchildren would no longer attend schools in inadequately funded districts. These beneficiaries and the districts in which they attend schools are a diverse group, as inadequate funding is a widespread problem. But a disproportionate share of our proposal’s beneficiaries attend schools in higher-poverty districts, and almost 60 percent are African American and Latinx students, who make up just over 40 percent of all students in our simulation.

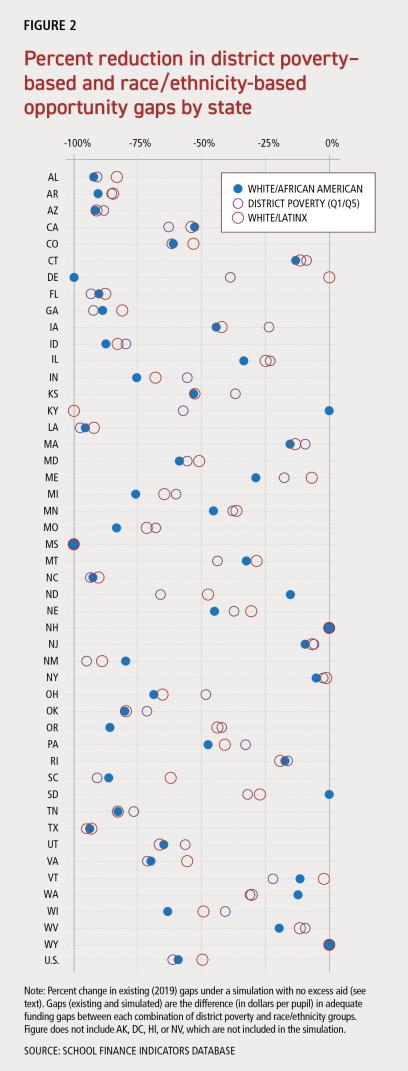

- Full participation would also reduce the overall unequal opportunity gap—the average difference in adequate funding gaps between the highest- and lowest-poverty districts in each state—by over 60 percent. On average, the 20 percent of districts in each state with the lowest poverty rates are funded approximately $3,400 per pupil above estimated adequate levels. In contrast, the highest-poverty districts are funded roughly at an equal amount below adequate levels, for a total “unequal opportunity gap” of just over $6,700 per pupil. Our proposed framework, with all states meeting minimum effort levels and additional federal funds filling adequate funding holes, would reduce that gap to $2,638 per pupil, a decrease of about 61 percent. (For state-by-state results, see the figure below.) In addition, the program would reduce the national opportunity gap between African American and white students by 59 percent, while the Latinx/white gap would decline by 49 percent. In several states, such long-standing poverty- and race-/ethnicity-based funding gaps would be largely eliminated.

We emphasize that several of the important features of our proposal and proof-of-concept simulation, such as the fair share effort levels and the selection of the student outcome for adequate funding targets, are flexible. We have chosen parameters that we believe are reasonable and attainable, and in our report we have made an effort to test and present separate results for different possibilities (e.g., different definitions of capacity in our effort measure). The actual design and implementation of our framework might require changes, and we believe it is flexible enough to meet these challenges. (To see results for different scenarios, including different minimum state and local effort levels, use the online data visualization tool accompanying our report: shankerinstitute.org/fedviz.)

The framework we lay out in this report is, most basically, a proposal for a new federal aid program, though this approach could also be used to allocate existing federal aid. Its most important benefit would be the improvement in student outcomes from more adequate and equitable funding in participating states. By bringing effort and capacity into the federal aid equation, as is the case in virtually all states’ systems, our framework ensures that the new federal funding goes where it is needed most.

Yet the framework is also designed with the longer-term goal of improving and harmonizing K–12 school finance at the state and local levels. While a handful of states’ finance systems do a reasonably good job of providing adequate funding for all students, most do not. Insofar as roughly 90 percent of all K–12 revenue comes from state and local sources, any serious effort to improve this situation will require substantial additional investment from states and districts. The federal government cannot compel such investment directly, but it can play a crucial role in helping the students most in need, while also incentivizing new state and local investment by rewarding states that contribute a reasonable fair share of their resources to public schools.

Bruce D. Baker is a professor in and the chair of the Department of Teaching and Learning at the University of Miami and the author of Educational Inequality and School Finance: Why Money Matters for America’s Students. Matthew Di Carlo is a senior fellow at the Albert Shanker Institute and the author of numerous reports on school funding and equity. Mark Weber is the special analyst for education policy at New Jersey Policy Perspective and a lecturer in education policy at Rutgers University. He is also a music teacher in Warren Township, N.J. This article was adapted from Ensuring Adequate Education Funding for All: A New Federal Foundation Aid Formula with permission from the Albert Shanker Institute.

*In part for these reasons, many state courts have reaffirmed that their constitutions mandate statewide school funding systems that take these factors into account. That is, they require states to make up the gaps between districts’ needs/costs and their ability to pay those costs with local revenue. (return to article)

†For technical reasons, we do not include Alaska, the District of Columbia, Hawaii, and Nevada, as well as a relatively small number of districts in various other states, in our simulation. The districts that are included serve roughly 95 percent of all US public school students. (return to article)

‡In our report, we provide two ways of determining capacity, one focused on the monetary value of states’ goods and services, the other on the sum of personal income for a state’s resident population. (return to article)

§It bears noting that this total amount of required new state and local investment is roughly equivalent to our estimates of how much total state and local funding would increase if all states returned to their average effort levels before the 2007–09 recession.3 The failure of most states to reinvest in their schools as their economies recovered from that recession has had disastrous consequences for the funding of schools and other public services, and a large portion of the required state and local investment increases in our simulation are making up that ground that was lost and never regained. (return to article)

Endnotes

1. B. Baker, How Money Matters for Schools (Palo Alto, CA: Learning Policy Institute, 2017); B. Baker, Educational Inequality and School Finance: Why Money Matters for America’s Students (Cambridge, MA: Harvard University Press, 2018); C. Candelaria and K. Shores, “Court-Ordered Finance Reforms in the Adequacy Era: Heterogeneous Causal Effects and Sensitivity,” Education Finance and Policy 14, no. 1 (2019): 31–60; C. Jackson, “Does School Spending Matter? The New Literature on an Old Question,” in Confronting Inequality: How Policies and Practices Shape Children’s Opportunities, ed. L. Tach, R. Dunifon, and D. L. Miller (Cambridge, MA: National Bureau of Economic Research, 2020), 165–86; C. Jackson, R. Johnson, and C. Persico, “The Effects of School Spending on Educational and Economic Outcomes: Evidence from School Finance Reforms,” Quarterly Journal of Economics 131, no. 1 (2016): 157–218; C. Jackson, C. Wigger, and H. Xiong, “Do School Spending Cuts Matter? Evidence from the Great Recession,” American Economic Journal: Economic Policy 13, no. 2 (2021): 304–35; and J. Lafortune, J. Rothstein, and D. Schanzenbach, “School Finance Reform and the Distribution of Student Achievement,” American Economic Journal: Applied Economics 10, no. 2 (2018): 1–26.

2. B. Baker and M. Weber, “State School Finance Inequities and the Limits of Pursuing Teacher Equity Through Departmental Regulation,” Education Policy Analysis Archives 24, no. 47 (2016): 1–36; and B. Baker and K. Welner, “Premature Celebrations: The Persistence of Inter-District Funding Disparities,” Education Policy Analysis Archives 18, no. 9 (2010): 1–30.

3. B. Baker et al., The Adequacy and Fairness of State School Finance Systems, 4th ed. (Washington, DC: Albert Shanker Institute, 2021).

[Illustrations by Paul Zwolak]